by Kenbry Capital | Oct 4, 2024 | Blog

Owning rental property can be a lucrative investment, but it also comes with its share of headaches and concerns. That’s where a property management company comes into play. Engaging the services of a professional property management company can bring a wealth of benefits to landlords, especially those who own multiple properties.

Professional Handling of Property Matters

A property management company takes over the hassle of dealing with property-related matters, from tenant screening to maintenance and rent collection. They have the experience and resources to handle issues efficiently, which can save you time, effort, and unnecessary stress.

High-Quality Tenants

Through rigorous screening processes, a property management company can secure high-quality tenants for your property — those who pay on time, rent longer, put less wear and tear on the unit, and cause fewer problems. Having such tenants can make your investment more profitable and less problematic in the long run.

Lower Maintenance and Repair Costs

Good maintenance and timely repairs keep tenants happy and preserve the value of your investment. Property management companies, often having in-house maintenance staff and bulk discounts from their network of contractors, can ensure that the job gets done right at a lower cost.

Effective Marketing and Rent Setting

Your property won’t generate income if it’s vacant. Property management companies can help minimize vacancies by effectively marketing your rental property to attract tenants. Additionally, they have an in-depth understanding of the local market and can set competitive rental prices to attract tenants and maximize your income.

Compliance with Property Laws and Regulations

With knowledge and understanding of the latest property laws and regulations, property managers can help you avoid lawsuits by keeping your property compliant. They can handle everything from federal to state and local regulations, ensuring you meet all necessary legal requirements.

Conclusion

While hiring a property management company does come with a cost, the benefits — from saving time and reducing stress, to ensuring compliance with laws and getting the best tenants — can significantly outweigh these costs. By entrusting your property to a competent property management company, you can sit back and enjoy the advantages of being a property owner without the headache of direct hands-on management.

by Kenbry Capital | Sep 6, 2024 | Blog

Investing in multifamily properties has long been recognized as a savvy real estate strategy. It offers the potential for consistent cash flow, risk spread over multiple units, and ample opportunities to increase value. However, maximizing returns requires more than just buying and renting out units. Here are five strategies you can implement.

1. Property Management

Effective property management is key to maximizing returns. A well-managed property attracts and retains quality tenants, reducing vacancy rates and turnover costs. Consider hiring a professional property management company that has the expertise and resources to handle everything from tenant screening to maintenance, legal issues, and customer service.

2. Regular Maintenance and Upgrades

Staying on top of regular maintenance not only keeps your property in good condition but can also prevent costly repairs in the future. Furthermore, strategic upgrades can significantly increase your property’s value and allow you to charge higher rents. Think energy-efficient appliances, modern fixtures, or improved landscaping.

3. Tenant Retention

High tenant turnover can lead to vacant units, lost rental income, and additional costs for advertising, screening, and preparing units for new tenants. Implement strategies to retain good tenants such as prompt responses to repair requests, regular property updates, and fostering a sense of community.

4. Rethink Amenities

Amenities can be a major draw for tenants and can justify higher rents. Determine what amenities your target tenants value the most. This could be anything from in-unit laundry and pet-friendly policies to communal spaces like a gym or rooftop terrace.

5. Strategic Financing

Choosing the right financing strategy can greatly influence your returns. Shop around for the best mortgage rates, consider refinancing if market conditions are favorable, and don’t overlook opportunities like 1031 exchanges or opportunity zones for tax benefits.

By adopting these strategies, you can maximize the returns on your multifamily property investment. Always remember, successful real estate investing is about more than just accumulating properties. It’s about managing them strategically and creating value at every opportunity.

If you need financing to acquire, renovate, or build a multifamily property, contact the team at Kenbry today.

by Kenbry Capital | Aug 2, 2024 | Blog

The financial planning of any large construction project is critical to its success. It demands careful consideration of diverse factors including labor costs, material costs, and administrative expenses. In this blog post, we’ll guide you through a systematic approach for creating a realistic and effective budget for large construction projects.

Understand Your Project Scope

The first step in budgeting is to thoroughly understand your project scope. This involves identifying all necessary tasks, required resources, and the timeline for completion. A detailed project scope helps you accurately forecast the costs involved, thereby reducing the risk of overspending.

Estimate Costs

The next step is to estimate the costs associated with each element of the project. This includes direct costs such as materials, labor, and equipment, as well as indirect costs like administrative expenses, permits, and insurance. It’s advisable to add a contingency for unexpected expenses as construction projects often encounter unforeseen challenges.

Track and Control Costs

Once your budget is set, it’s crucial to continually track and control your costs. Use project management tools to monitor your spending and ensure they align with your budget. Regularly review your expenses and make necessary adjustments to keep your project within budget.

Review and Adjust Your Budget

Remember, a budget is not a rigid document but a flexible tool that should adapt to the realities of the project. Conduct regular budget reviews and make adjustments as necessary based on project progress and unforeseen changes.

Remember, budgeting for large construction projects can be a complex process, but with careful planning, diligent tracking, and regular revisions, it is possible to keep your project financially healthy and ensure its success. If you need ongoing to permanent financing for a large construction project, reach out to the team at Kenbry today.

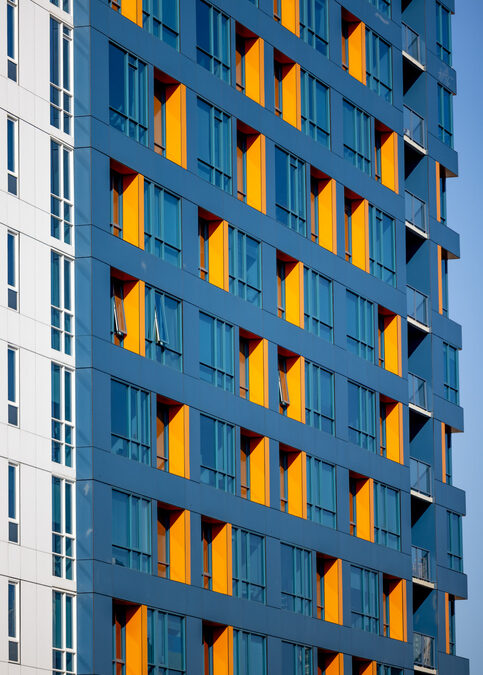

by Kenbry Capital | Jul 5, 2024 | Blog

Real estate investment, particularly multifamily property investments, is a proven strategy to build wealth. So, if you’re considering this route, here’s a comprehensive guide to set you on the right path.

Understanding Multifamily Property Investments

Multifamily properties are primarily residential properties that have more than one unit for tenants, such as duplexes, triplexes, and apartment buildings. These property types offer unique advantages for investors, including multiple streams of income, lower risk of total income loss, and economies of scale that can reduce per-unit costs.

Steps to Building Wealth Through Multifamily Property Investments

- Education and Research

Before diving into multifamily property investing, it’s essential to educate yourself on the subject. Arm yourself with knowledge on real estate investing, market trends, how to evaluate potential property investments, and the legalities involved in owning and operating rental properties.

- Financing

Identify your financing options early on. These options could include traditional bank loans, private lending, or even partnering with other investors. Pre-approval can give you a competitive edge when it comes to negotiating and closing deals.

- Property Selection

When it comes to property selection, consider the location, the condition of the property, potential rental income, and the costs of any necessary renovations. Look for properties in areas with high rental demand and low vacancy rates.

- Acquisition and Renovation

Once you have a potential property in sight, negotiate the purchase price and finalize the deal. If the property requires renovations, hire reliable contractors and manage the project effectively to avoid cost overruns.

- Property Management

Effective property management is key to a successful multifamily property investment. This can involve everything from tenant screening, lease management, maintenance, to rent collection. You can choose to manage the property yourself or hire a professional property management company.

- Growth Strategy

Finally, develop a growth strategy for your investment portfolio. This might involve refinancing properties to free up capital for additional investments or selling properties that have appreciated in value to invest in larger, more lucrative properties.

Building wealth through multifamily property investments can be a challenging yet rewarding journey. By planning well, staying informed, and being diligent in your approach, you can create a robust and profitable real estate portfolio. Remember, every investment comes with risks, so it’s important to assess every opportunity carefully. Contact Kenbry today to get the financing you need for multifamily investments.

by Kenbry Capital | Jun 7, 2024 | Blog

Short sales can be a great way to snap up a property at a bargain price. However, these transactions often need to be completed in a short time frame, which can be challenging if you’re waiting for a traditional loan to be approved. This is where bridge loans come in.

Understanding Bridge Loans

Bridge loans are short-term loans designed to bridge the gap between the purchase of a new property and the sale of an existing one. They offer immediate cash flow, allowing you to secure a property quickly and repay the loan when your existing property sells.

Using Bridge Loans for Short Sales

- Quick Property Acquisition

One of the primary benefits of bridge loans is the speed at which funds can be acquired. This is crucial in a short sale scenario where the seller may be looking to close quickly. Obtaining a bridge loan can help you meet these time constraints and secure your desired property.

- Flexibility

Bridge loans offer a considerable amount of flexibility. You can use these loans to cover the cost of your new property, any necessary repairs, or even expenses such as staging your existing home for sale.

- Temporary Solution

It’s important to remember that bridge loans are a temporary solution. They are typically designed to be paid back within a year, once your original property has sold.

Risks and Considerations

While bridge loans can be an excellent tool for short sales, they are not without risks. These loans often come with higher interest rates than traditional mortgages. Additionally, if your existing property doesn’t sell as quickly as anticipated, you may end up paying more in interest.

Conclusion

If used wisely, bridge loans can be a powerful tool in short sale transactions, allowing purchasers to act quickly and secure their desired property. It’s essential to understand the nature and terms of the bridge loan, the market conditions, and your financial situation to make the most of this financing option. Seeking advice from a financial advisor or mortgage professional can also be beneficial.

Remember that while bridge loans can provide the funds needed to complete a short sale quickly, they are a short-term solution and should be treated as such. Plan thoroughly, and be prepared for all possible outcomes to ensure a successful property transaction. Reach out to the team at Kenbry if you need customized financing for a short sale.